|

|

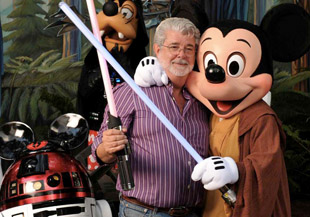

Top 12 Film Industry Stories of 2012: #1The Force Is with DisneyBy David MumpowerJanuary 9, 2013

Obviously, Lucasfilm Ltd. includes more than just that movie franchise. Simply by adding Industrial Light & Magic, the special effects company created by Lucas, Disney created a new level of vertical integration within their company. By owning ILM, far and away the best special effects company in the business, the Mouse House instantly reduced the costs of all their major upcoming blockbusters. They will no longer be forced to pay third party pricing for their special effects. Conversely, they can overcharge competing studios who will also continue to use ILM for their needs, thereby offsetting some of the cost in acquiring Lucasfilm. This is an arcane asset. The more tangible asset for Disney is the ability to create more Star Wars movies. Simultaneous with the announcement of purchase, CEO Bob Iger offered glorious news to fans of Lucas’ storied franchise. A new movie will be released in 2015, the first of a long rumored trilogy concluding Lucas’ initial story arc from the 1970s. Three more movies combined with ever-increasing film ticket prices and overseas revenue potential means that the new trilogy alone should gross $3 billion in global box office. Disney also intends to create television programming for their networks, which include the Disney Channel (natch), Disney XD and ABC. The Star Wars universe will be ubiquitous in coming years. Amazingly, all of the above borders on irrelevant. What matters the most here is that the world’s largest toy merchandiser has just acquired the most coveted independent brand. Star Wars paraphernalia was already earning as much as $3 billion a year without Disney marketing. Sales should spike in coming years as Disney exploits previously untapped revenue potential. The initial financial outlay of $4.05 billion will border on negligible after only a few years, just as was the case with Disney’s purchases of Pixar and Marvel Entertainment. In one fell swoop, Disney guaranteed more annual merchandising revenue. Always the philanthropist, George Lucas took a lot of that money and pledged to spend it on education. And the rest of us will get our first new Star Wars movie in a decade in 2015. Simply put, there is nothing but upside to this transaction for Disney, George Lucas and pretty much all the rest of us. We the people win with Star Wars becoming a Disney property. We get more Star Wars while Disney picks our wallets clean, which they were already doing anyway.

[ View other Top 12 Movie Industry Stories of 2012 ]

[ View other BOP Lists ]

[ View columns by David Mumpower ] [ Email this column ]

|

|

|

|

|

Saturday, May 4, 2024

© 2024 Box Office Prophets, a division of One Of Us, Inc.